One of the principal perks of personal banking company loans is their adaptability. Unlike various other types of loans that are designated for details functions, such as mortgage loan car loans or automobile financings, private financial institution lendings may be utilized for a broad variation of expenditures. This means that debtors possess the flexibility to make use of the funds as they observe in good condition, whether it's for education and learning expenditures, health care expenses, or even a goal holiday.

Yet another benefit of individual banking company car loans is the simple and effortless app process. With conventional financial institution lendings, applicants typically possess to go with a extensive approval procedure that involves submitting a variety of records and going through credit report examinations. However, private banking company financing apps are commonly uncomplicated and demand minimal information. This helps make it easier for individuals to get permitted rapidly and access the funds they require in a well-timed manner.

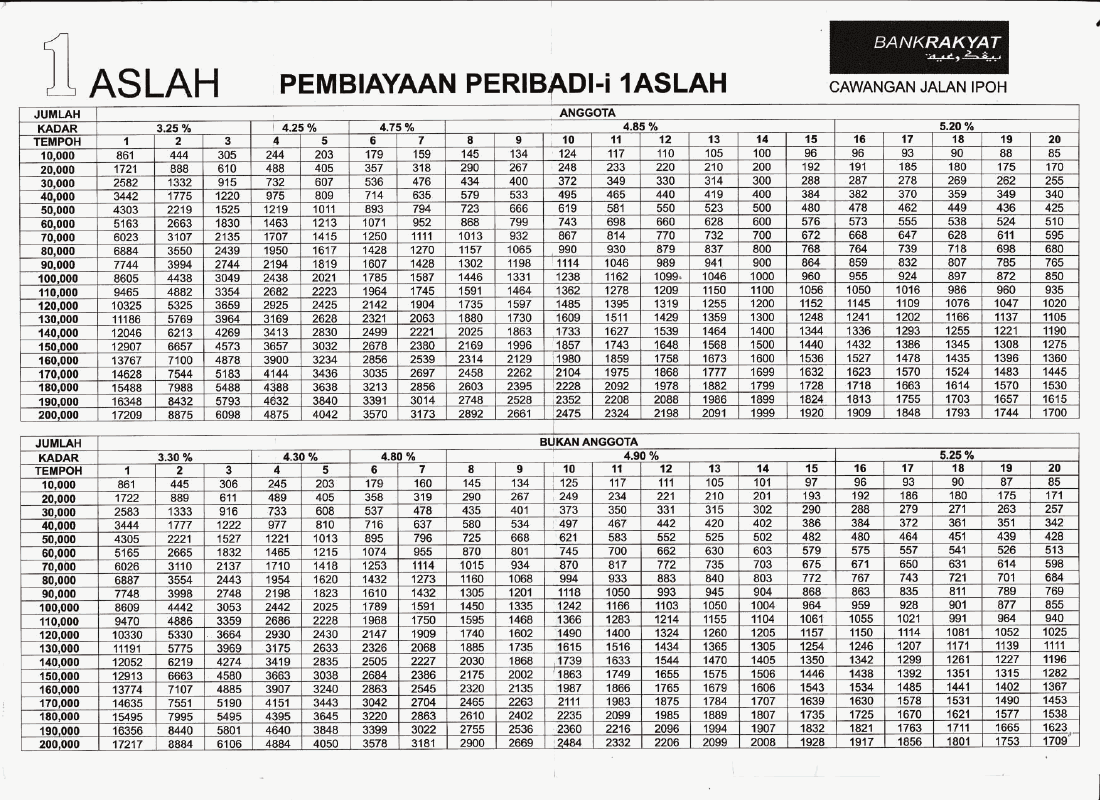

Also, personal banking company lendings typically come along with competitive interest rates contrasted to various other forms of borrowing. This is because these types of lendings are often unsecured, meaning they do not require any sort of security. As a result, banking companies might give lower enthusiasm rates as they take on additional risk by offering loan without any sort of surveillance. Debtors can help coming from these lesser fees through conserving amount of money on passion repayments over the training program of their car loan condition.

Furthermore, private financial institution finances deliver debtors along with foreseeable regular monthly repayments. Unlike credit report memory cards or series of credit history where repayment quantities can rise and fall based on outstanding equilibriums and interest prices that vary over time, individual banking company loan monthly payments remain dealt with throughout the financing phrase. This allows consumers to allocate efficiently and plan their finances accordingly without worrying regarding unexpected payment boost.

One more benefit of selecting pembiayaan peribadi is the possibility to improve one's credit score score. Through taking out a personal financial institution funding and making regular, quick settlements, debtors can easily illustrate responsible economic actions, which may favorably influence their creditworthiness. This may be particularly helpful for people along with lesser credit scores ratings who are appearing to reconstruct their credit scores history.

Also, personal financial institution financings usually happen with pliable repayment phrases. Borrowers have the choice to opt for from numerous loan periods varying coming from a couple of months to many years, relying on their monetary situation and tastes. This versatility makes it possible for customers to choose a payment schedule that aligns along with their income and ability to help make regular monthly repayments conveniently.

Last but not least, private bank car loans deliver tranquility of mind and financial security. In opportunities of unanticipated expenditures or urgents, having accessibility to funds with a individual bank loan can give individuals along